5 reasons to stick with a debt management plan

Getting out of debt can be an incredible challenge. Managing multiple payments, soaring interest rates, and never ending collection calls get old incredibly fast.

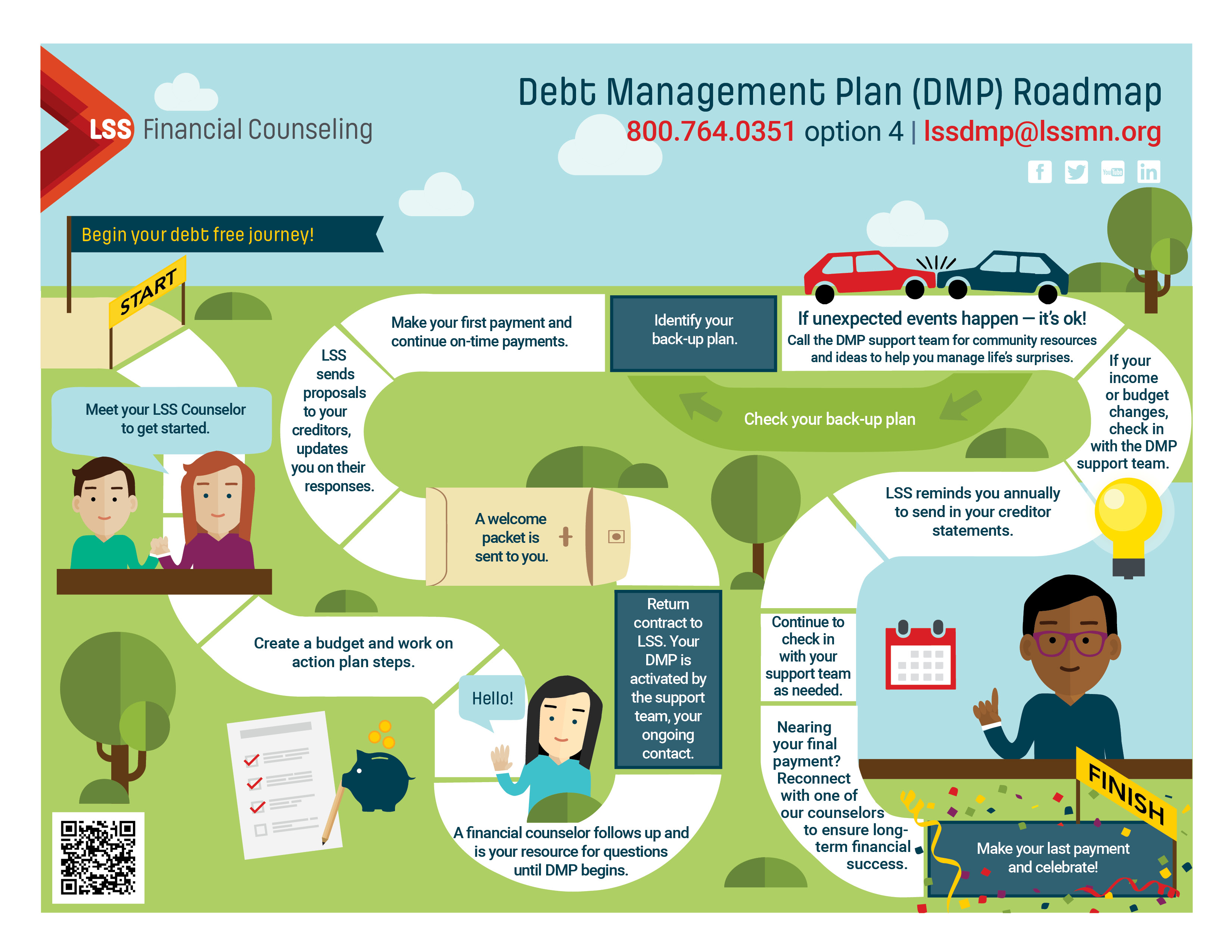

If a Debt Management Plan is part of your debt free journey, it's important to stick with it to the end. Bumps in the road might be common, but keep in mind that you are taking steps in the right direction! Here are five reasons to stick with a DMP.

1. Reduced Fees & Interest

Payments for a DMP are typically lower than your current payments. Additionally, most creditors will significantly reduce interest rates and stop fees once you are on a DMP.

"I have had clients I've worked with who have saved tens of thousands of dollars on a DMP versus paying it off on their own."

Shannon Doyle, LSS Financial Counselor

Saving your hard earned money is fantastic, but the best part of all the savings is that it helps break free from debt. Often times the minimum payments for credit cards don't even pay down the accrued interest, which creates an endless cycle of debt.

2. Simplifying Repayment

Juggling multiple payments and due dates is a hassle. A DMP provides you the simplicity of one payment and one due date. Life is complicated enough - let us handle the details to ensure all creditors are paid on time.

Did you know that you can add new accounts to the DMP? Feel free to get in touch with the DMP Support Team or your counselor with any additions you would like to add. Just make sure that all promotional rates on the account(s) that you are looking to add have expired. Once we confirm that the new account is applicable, we will send you out a revised contract for you to review and sign!

3. A Supportive Team

Navigating debt repayment can not only be complicated, but it can also get difficult to take it on solo. With a DMP at LSS, you have an experienced team advocating for you and helping you work through any issues with creditors.

If you're struggling to keep up with payments, the unexpected occurs (job loss, car repairs, medical bills, etc.), or you just have questions about your DMP, the DMP Support Team is always here to off non-judgmental assistance.

We can also do a “DMP review” appointment where a counselor can check with you on your current financial situation. We can refresh your budget and see if there are some other areas to your finances that can be adjusted.

4. Debt Freedom in 5 Years or Less

With a DMP, you are debt free in 5 years or less. Without the reduced interest rates and waived fees, repaying the same debt will often take double or triple the time, depending on several factors. Sticking with the DMP means debt freedom in 5 years or less!

Did you know that you can pay more than the standard monthly payment on your DMP? There is NO pre-payment penalty with a DMP! Therefore, any additional money that you pay on top of your normally monthly will go towards your balances. It could even potentially accelerate the time of your DMP!

5. Better Credit

As long as there are no new debts that are past due or in collections being added to your overall debts, most likely your credit score is increasing!

Did you know that we can pull another copy of your credit report to see how you have been progressing? Schedule another appointment set up with a counselor here at LSS for a credit report review. It is free and a will not adversely affect your credit. During a credit report review, we can see if your credit score is having an upward trend. It it's not, we'll try to identify any potential issues that might be keeping it down.

If you're interested in meeting with a financial counselor for a credit report review or budget review at any point during your DMP, call 888.577.2227 to set up your free appointment.

If you have any questions about your DMP, you can contact the DMP Support Team by calling 800.764.0351 or emailing lssdmp@lssmn.org.

Author Dan Park is a certified LSS Financial Counselor.